Powered By EmbedPress

Powered By EmbedPress

1. Introduction

We provide end-to-end support for businesses in Germany with the preparation and submission of monthly, quarterly, and annual VAT returns. Our services ensure full compliance with German tax law (Umsatzsteuergesetz), timely submissions via ELSTER, and optimization of VAT cash flow.

2. Filing Frequencies in Germany

Monthly VAT Return (Umsatzsteuervoranmeldung – monatlich)

Required for most businesses in the first two years after VAT registration.

Also, mandatory if annual VAT liability exceeds €7,500.

Deadline: 10th day of the following month.

Example: VAT for March must be filed and paid by April 10.

Quarterly VAT Return (Umsatzsteuervoranmeldung – vierteljährlich)

Allowed if annual VAT liability is between €1,000 and €7,500.

Deadline: 10th day after the quarter ends.

Q1 (Jan–Mar): April 10

Q2 (Apr–Jun): July 10

Q3 (Jul–Sep): October 10

Q4 (Oct–Dec): January 10 (next year).

Annual VAT Return (Umsatzsteuererklärung – jährlich)

Mandatory for all VAT-registered businesses, regardless of monthly or quarterly filings.

Serves as a reconciliation of all VAT reported during the year.

Deadline: July 31 of the following year.

Example: 2025 return is due by July 31, 2026.

3. Our VAT Filing Workflow

Data Collection: Sales invoices, purchase invoices, imports/exports.

Input & Output VAT Calculation: Correct treatment of 19% and 7% VAT rates, intra-EU supplies, reverse charge.

Filing & Submission via ELSTER: Monthly or quarterly provisional returns, Annual VAT reconciliation.

Payment & Compliance: Ensure payment deadlines are met, Avoid penalties (Verspätungszuschlag, Säumniszuschlag).

4. Why Work with Us

Expertise in all filing frequencies: monthly, quarterly, and annual.

Accurate and timely submissions to the Finanzamt.

Transparent advisory tailored to your business model.

Multi-jurisdiction knowledge (Germany, EU, UK, USA, UAE).

Powered By EmbedPress

1. Introduction

VAT registration in Germany is a legal requirement for businesses that exceed specific turnover thresholds or engage in cross-border transactions. Navigating the process can be complex, especially for international businesses entering the German market. We provide full support with German VAT registration, ensuring your business is correctly set up, compliant, and ready to trade in the EU.

2. Who Needs VAT Registration in Germany?

Domestic Businesses: Companies and freelancers exceeding the small business threshold (Kleinunternehmergrenze of €22,000 in the previous year and €50,000 in the current year).

EU Companies: Businesses selling goods or services in Germany.

Non-EU Companies: Importers and online sellers (Amazon, eBay, Shopify, etc.) supplying goods to German customers.

E-Commerce Sellers: Distance sellers reaching the €10,000 EU-wide OSS threshold.

Service Providers: Offering digital services to German customers.

3. Our VAT Registration Process

Initial Consultation

Assess your business model and determine VAT registration requirements.

Preparation of Documentation

Company incorporation documents.

Company Tax Number

Passport/ID copies of directors.

Business Activity

Application Submission

Filing the VAT registration form

Communication with the relevant German tax office (Finanzamt).

Will also be your Post Receiving agent in Germany

Issuance of VAT Number (USt-IdNr & Steuernummer)

Receive your VAT ID (USt-IdNr)

Receive your Tax Number (Steuernummer)

4. Timeline

Standard VAT registration: 4–6 weeks.

For international companies: may take 6–10 weeks, depending on documentation and tax office workload. (It can take more time as well totally depends on Tax Office Workload)

5. Benefits of Proper VAT Registration

Legally compliant operations in Germany and the EU.

Ability to reclaim input VAT on German business expenses.

Access to Amazon FBA, eBay, and other EU marketplaces.

Avoidance of fines, penalties, or trading restrictions.

Strengthened credibility with partners and clients.

6. Why Choose Us

Expert Knowledge: We handle VAT registration for German, EU, and non-EU businesses.

End-to-End Service: From documentation to communication with the Finanzamt.

Cross-Border Expertise: Guidance on OSS schemes, EU VAT, and import VAT.

Trusted Advisory: Transparent pricing, reliable communication, and timely results.

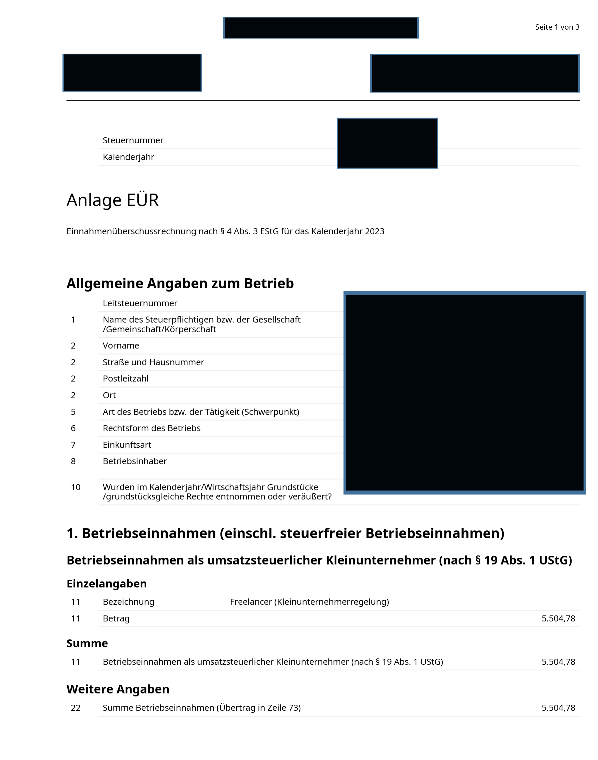

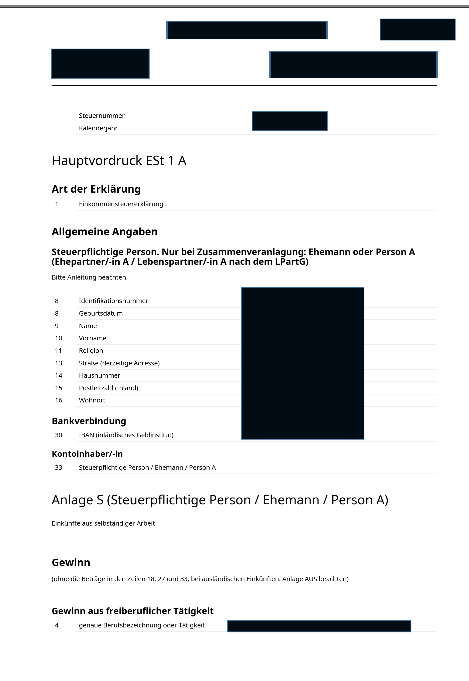

Our Expertise

We handle all aspects of German income tax, including:

Einnahmen-Überschuss-Rechnung (EÜR) for freelancers and small businesses

Gewerbesteuererklärung (Trade Tax Declaration)

Anlage S / G – Self-employment & business income

Anlage N – Employment income

Anlage KAP – Capital gains & investments

Anlage V – Rental income & property taxation

Anlage AUS – Foreign income (Double Taxation Agreements)

Anlage R – Pension income

Tax Saving Strategies We Apply

Expense Optimization: Maximizing deductions (home office, IT equipment, training, subscriptions)

Capital Gains Planning: Loss-offsetting, long-term holding exemptions (§23 EStG), Sparer-Pauschbetrag

Rental Property Efficiency: Deductible interest, repairs, depreciation (AfA)

Freelancer Support: Structuring expenses to reduce taxable income

International Clients: Double Taxation Relief through DBA treaties

Why Choose the Tax Square?

✔️ Expertise in German & International Taxation

✔️ ELSTER-compliant filings (official Finanzamt platform)

✔️ Personalized tax-saving strategies

✔️ Transparent pricing & clear communication

Contact us

The Tax Square